5 Easy Facts About Ach Processing Explained

Table of ContentsGetting The Ach Processing To WorkFacts About Ach Processing UncoveredRumored Buzz on Ach ProcessingAch Processing Fundamentals Explained

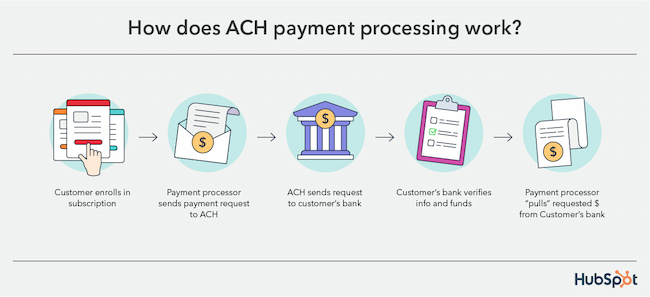

A lot more lately nevertheless, financial institutions have actually pertained to permit same day ACH payments or next-day ACH transfers that take just one to 2 organization days. So as long as the digital settlements demand is sent prior to the cutoff for the day, it's possible for the cash to be obtained within 24 hrs - ach processing.Whatever kind of ACH repayments are included, a transfer is a procedure of 7 steps, which begins with the cash in one account and also ends with the money showing up in one more account. ACH payments begin when the pioneer (payer)starts the procedure by asking for the deal. The begetter can be a consumer, service, or a federal government firm.

When a deal is initiated, an access is sent by the bank or payment processor managing the very first phase of the ACH payments procedure. The financial institution or repayment processor is understood as the Originating Depository Financial Organization (ODFI). Financial establishments usually send out ACH entries in sets, generally 3 times a day throughout regular business hrs.

Federal Book banks as well as the EPN are national ACH drivers. Once obtained, an ACH driver kinds the batch of entries right into deposits as well as payments, as well as repayments are after that arranged right into ACH credit score and also debit settlements.

Some Ideas on Ach Processing You Need To Know

When getting ACH repayments, the obtaining monetary institution either credit scores or debits the receiving bank account, depending on the nature of the deal. While the total price connected with approving ACH settlements varies, ACH costs are often much more affordable than the charges related to accepting card repayments. One of the largest cost-influencers of accepting ACH settlements is the volume of purchases your organization means to procedure.

When accessing ACH indirectly via a Third Event Payment Cpu (TPPP), a number of kinds of fees might be involved: While both wire transfers (like SWIFT) and also ACH payments allow for electronic payment of funds to savings account, the primary difference is that wire transfers are used to help with worldwide settlements, whereas electronic ACH settlement is only available locally. Whether you're an acquirer, settlements processor or merchant, it's critical to be able to acquire total real-time exposure into your settlements ecological community. Badly executing systems enhance frustration throughout the entire repayments chain. It can cause lengthy lines up, the possibility of go to website consumers deserting acquisitions, and discontentment from consumers seriously impacting revenue.

IR Transact simplifies the complexity of managing modern repayments ecosystems, including ACH payments. Bringing real-time exposure as well as repayment monitoring to your whole atmosphere, Transact uncovers unparalleled insights into ACH deals as well as payments patterns to assist you streamline the payments experience, turn data into knowledge, and guarantee the payments that maintain you in service.

Ach Processing Fundamentals Explained

Possibilities are you have actually already made use of ACH settlements, yet are not familiar with the lingo. ach processing. Some of the instances of ACH deals include: Online expense payments via your bank account, Transferring money from one financial institution account to an additional, Paying vendors or getting cash from customers through straight down payment, Straight down payment payroll to an employee's checking account used by business, Allow's check out ACH repayment refining a lot more in information.

, ACH repayments per day went beyond 100 million in February 2019. 1% rise in ACH transaction quantity for the very first quarter of 2020, with B2B settlements uploading an 11.

You move cash to a Silicon Valley Bank account from your Bank of America account. Both the banks have to credit rating as well as debit each other's accounts.

ACH is one such main clearing system for financial institutions in the US. check my site ach processing. Wire transfers are interbank digital repayments. While cord transfers seem to be similar to ACH transfers, below are some crucial differences in between them: Can take a couple of organization days, Immediate, Free for a receiver, small charges ($1) for a sender, Both the sender and also receiver are billed charges.

Ach Processing for Dummies

Can be challenged if conditions are met, When launched, can not be canceled/disputed, No human intervention, Typically includes teller, Both send out and also request repayments. For repayment demands, you need to submit the ACH file to your bank. Just send out payments, Refined in sets, Refined real-time, A cord transfer is optimal for you when time is important, while ACH handling is a far better choice for non-mission-critical as well as reoccuring payments. Currently in any kind of transfer, two people are included.

/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png)

Your consumer licenses you to debit their bank account on his part for recurring purchases. Let's say Jekyll needs to pay an amount of $100 to Hyde (presume they're Look At This two various people) as well as determines to make a digital transfer. Below is a detailed malfunction of how a financial institution transfer by means of ACH works.

Comments on “Getting The Ach Processing To Work”